Vicarious liquidation – Swiss withholding tax

18.05.2022Court decision on the so-called vicarious liquidation in international relations

In a much-noticed decision (BVGE A-4347/2019), the Federal Administrative Court on March 10, 2022, established the vicarious liquidation of a real estate company and confirmed the full refusal of the withholding tax refund.

Facts

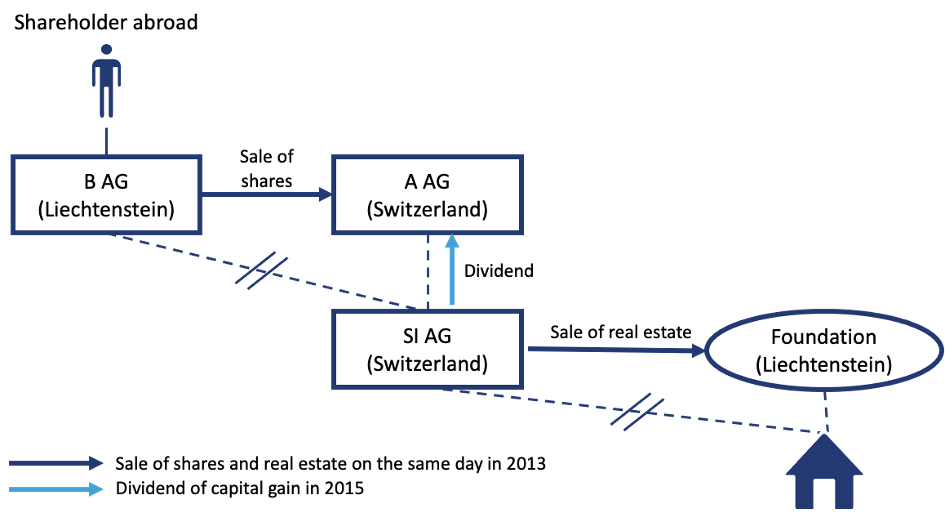

B AG, which is controlled by a shareholder abroad, sold the shares in the Swiss real estate company SI AG to A AG, which is domiciled in Switzerland. The main asset of SI AG was a real estate in Switzerland with a book value of CHF 5.1m. On the same day, SI AG sold the property to a Liechtenstein foundation at a price of CHF 18.2m, resulting in a capital gain of CHF 12.6m after deduction of transaction costs. In other words, on the day of the sale of the shares, hidden reserves were realized by the sale of the real estate on the same day. From this gain, SI AG paid a dividend of CHF 9.97m to its new shareholder A AG in 2015.

For the dividend of SI AG, A AG first applied for the notification procedure and (after its refusal) for the refund of the withholding tax of CHF 3.5m.

Decision of the Federal Administrative Court

The Federal Administrative Court concludes, based on an assessment of the circumstances, that tax avoidance has occurred. In particular, the plaintiff’s argument that they had originally wanted to hold the property and had only sold it due to an extraordinary opportunity was not successful. According to the Federal Administrative Court, the temporal proximity between the sale of the shares and the sale of the property on the same day and further indications in connection with the real estate transaction speak against this in the present case. Rather, the court recognizes in the sale of the property in 2013 without reinvestment of the funds received thereby the initiation of the de facto liquidation of SI AG, which was completed with the dividend in 2015.

The Federal Administrative Court also refuses the contingent application for a refund of the withholding tax to the extent of the residual tax rate of 15% of the previous shareholder. In doing so, the Federal Administrative Court refers, on the one hand, to the lack of proof of the previous shareholder’s eligibility for the application of a double taxation agreement and, on the other hand, to the general refusal to refund withholding tax in tax avoidance cases.

Implications for the taxpayers

The present ruling is a clear reminder that the practice of the FTA on vicarious liquidation can have very negative withholding tax consequences for the parties involved in individual cases. In particular, hidden reserves existing at the time of the transaction may also be covered by the practice and, if qualified as tax avoidance, the refusal to refund may not even be mitigated to the residual tax rate.

Buyers of Swiss companies who intend to dispose of significant assets of the acquired company shortly after the acquisition should therefore carefully consider the risk of a future refusal to refund withholding tax.